Description

The course is specially designed with an aim of developing skills and competency in Derivatives markets. It is a detailed program on equity derivatives suggested to be completed in the period of One month. Special care is taken is to keep the lessons in easy language for better understanding. It is an endeavour which promises to impart a strong understanding of derivatives traded in Indian markets. The course begins with the basics and takes your through the most advanced derivatives trading strategies and pricing structures as such provides broader perspective. This course is ideal choice for students aspiring to become derivatives professionals or investors/traders who wishes to take advantages of derivatives to strengthen their trading portfolio.

The course coves basics of derivatives, its products like forwards, futures and options, its applications, trading in index, trading strategies, regulatory framework, accounting and taxation angle and much more. As such, this course may also be used for preparing for NISM Series VIII certifications.

Demo

What’s inside

Course contains Video lessons with detailed explanation in easy language of equity derivatives. The audio visual treat keeps the learning cover steep yet easy. It also contains Question bank with about 150 questions and mock tests

Suitable for :

Students aspiring to become financial markets professionals, Dealers, Derivatives traders, investors, Sub brokers etc.

Curriculum

ED Unit 1: Basics of Derivatives

- Topics covered : Basics of Derivatives, Indian Derivatives Market, Market Participants, Types of Derivatives Market, Significance of Derivatives, Various risk faced by the participants in derivatives

ED Unit 2: Understanding Index

- Topics covered : Introduction to Index, Significance of Index, Types of Stock Market Indices, Attributes of an Index, Index management, Major Indices in India, Application of Indices

ED Chapter 3: Introduction to Forwards and Futures

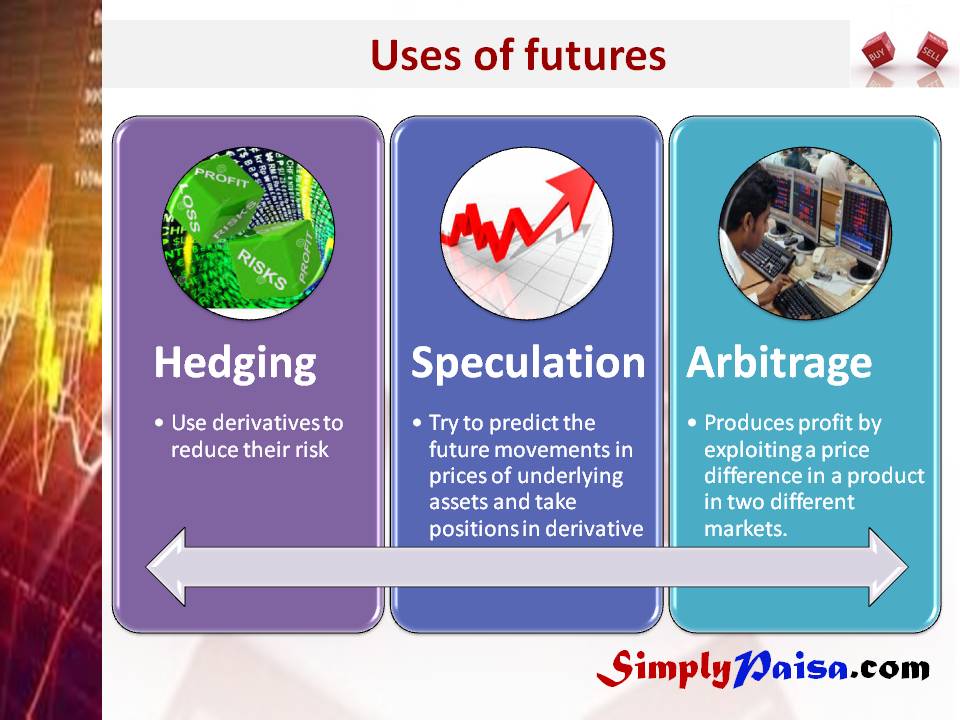

- Topics covered : Introduction to forwards and futures, Payoff Charts for Futures, Futures, Commodity, Equity & Index, Uses of futures

ED Chapter 4: Introduction to Options

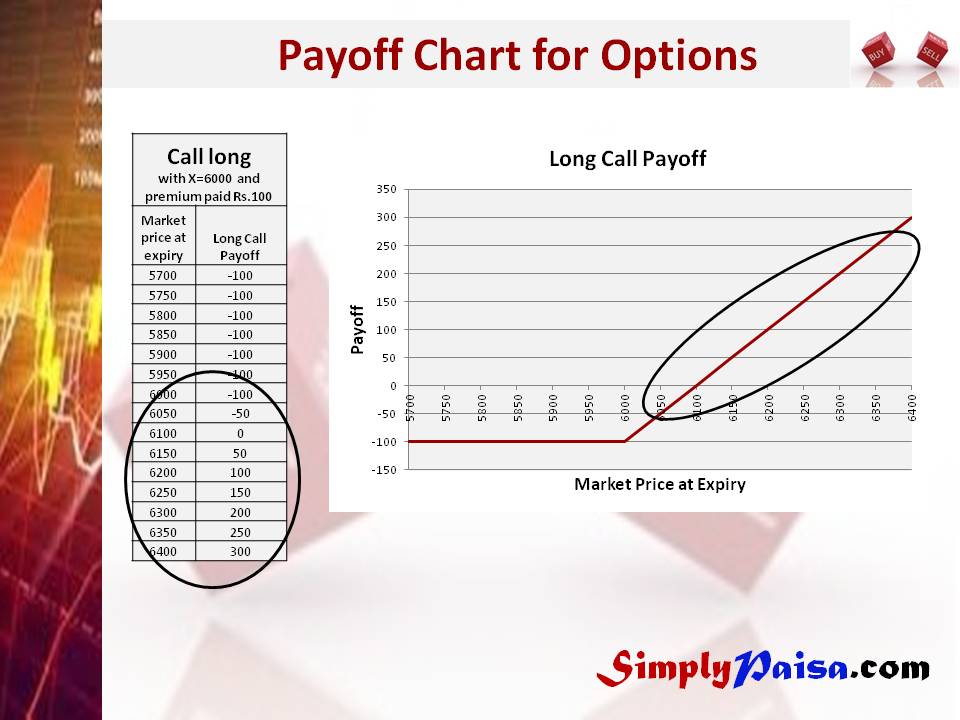

- Topics covered : Basics of Options, Pay off Charts for Options, Basics of Option Pricing and Option Greeks, Uses of Options

ED Chapter 5: Option Trading Strategies

- Topics covered : Option Spreads, Straddle, Strangle, Covered Call, Protective Put, Collar, Butterfly Spread

ED Chapter 6: Introduction to Trading Systems

- Topics covered : Trading System, Selection criteria of Stock for trading, Selection criteria of Index for trading, Adjustments for Corporate Actions, Position Limit, Using Daily Newspapers to Track Futures and Options

ED Chapter 7: Introduction to Clearing and Settlement System

- Topics covered : Clearing Members, Clearing Mechanism, Settlement Mechanism, Understanding margining and mark to market under SPAN, Risk Management

ED Chapter 8: Legal and Regulatory Environment

- Topics covered : Securities Contracts (Regulation) Act, 1956, Securities and Exchange Board of India Act, 1992, Regulation in Trading, Regulations in Clearing & Settlement and Risk Management, Outline major recommendations of the L.C.Gupta Committee, Outline major recommendations of the J.R.Verma Committee

ED Chapter 9: Accounting and Taxation

- Topics covered : Accounting, Taxation of derivative transaction in securities

ED Chapter 10: Sales Practices and Investors Protection Services

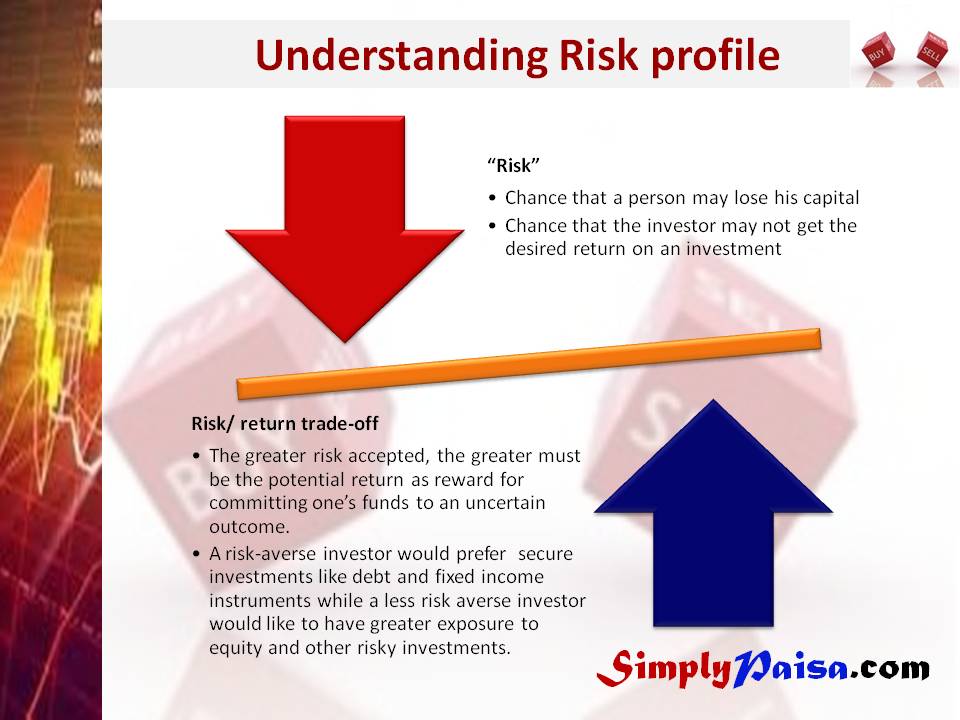

- Topics covered : Understanding risk profile of the investors, Investors Grievance Mechanism

ED Question Bank (400+ questions)

Assessment Test